by Philippe Van Parijs

When we are thinking about how the European Union should evolve, what competences it should be given, what direction it should take, what is the ultimate objective? The answer is simple: justice. But what is justice? Any conception of justice relevant for our times must combine two elements, both strongly rooted in our European traditions, but neither of them exclusive to them: equal respect for the diversity of conceptions of the good life that characterizes our pluralist societies and equal concern for the interests of all members, present and yet to come, of the society concerned. This concern, moreover, must be responsibility-sensitive — distributive justice is not a matter of outcomes but of opportunities— and it must be efficiency-sensitive — a fair distribution need not be a strictly equal distribution, but rather one that sustainably maximizes the condition of the worst off. Justice, in brief, means real freedom for all, the greatest real freedom for those with least of it. [1]

But who are the “all” among whom distributive justice requires that real freedom should be distributed fairly? All citizens of our nation-state? All citizens of the European Union? All members of mankind. My answer, here again, is quite simple : “all” means “all”, “justice” means “global justice”. As regards the fair distribution of resources, any distinction made between human beings in terms of which nation they belong to is as ethically unsustainable as are distinctions made in terms of gender or race. This is not to say, however, that nation states should vanish. But they are sheer tools to be used, not moral entities to be honoured. [2]

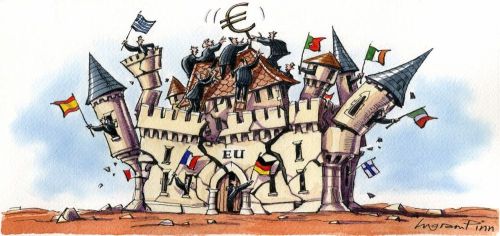

It is against this normative background that we need to appreciate both the mind-boggling, unprecedented achievement constituted by this weird political entity now called the European Union and the frightening, unprecedented challenges it now faces. To appreciate the magnitude of the achievement, just remember John Stuart Mill’s persuasive indictment of multinational and especially multilingual democracy. A multinational political entity can live together forever under a despotic regime, Mill wrote. But make it democratic, and it will fall apart, with political borders soon tending to coincide with national borders. [3] And yet we have the European Union, indeed even one that grew much faster than some said it should have done, through the voluntary Anschluß of one country after another. True, the process of European integration is imperfect, messy, chaotic, tortuous, frustrating and, many would say, profoundly undemocratic. But once aware of the obstacles, how can you expect the road to be straight? The task of combining respect for our national and linguistic diversity with effective democratic decision-making in the service of justice is daunting. But there is no alternative to getting it done: because it is needed to avoid dramatic social regression for our own people, but also because the European Union offers the closest approximation in the history of the world to the sort of institutional framework we increasingly need at the global level. [4]

Why inter-personal solidarity needs to be Europeanized

Among the many components of this task, none matters more to the sustainable achievement of social justice than the reshaping of the relationship between welfare state institutions and the single European market. The core of the challenge can be outlined as follows.

When discussing the role of the EU in social policy as in any other domain, it makes sense to appeal to the principle of subsidiarity, understood as a rule for ascribing the burden of proof: when there is a choice between two levels of democratic government for the allocation of a particular competence, always start with a presumption in favour of the lower, more decentralized level. Why? For four general reasons. Firstly, opting for the lower level leaves more room for diversity, for experimentation and hence for mutual learning. Secondly, it makes it possible to have policies more responsive to local objective circumstances. Thirdly, it makes it possible to have policies more responsive to local preferences, as shaped by the local public debate. Fourthly, it makes it possible to make decision-makers more accountable to those who are supposed to benefit from the policies and to pay for them.

In addition, there is a fifth reason that applies specifically to social policy, in so far as it is genuinely redistributive: the lower the level, the more homogeneous the population involved, the greater the political viability of generous redistribution, as a result of greater trust, of greater mutual identification, of greater “fellow-feeling”. This specific reason but also the last two general reasons are particularly strong when opting for the lower level which enables one to function at the level of linguistically more homogeneous populations. This is obviously the case if social policy competences are located at the level of the member states rather than at the level of the EU. [5]

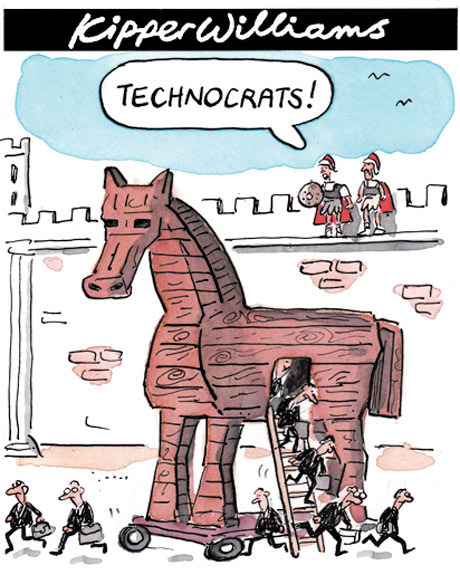

So is the matter settled? Not at all. Because the subsidiarity principle states no more than a presumption, and one that happens to be vulnerable, in this particular case, to a number of considerations which, taken together, call for direct EU involvement in social policy of an unprecedented nature and magnitude. The first of these considerations can be expressed by means of a paradox. [6] What should the EU do in matters of social policy in order to have a maximal impact on the member states’ social policies? Just do nothing. Just let the four freedoms — the free movement of labour, capital, goods and services — do their job. Let them make their powerful pressure fully felt through the mutual adjustment of self-interested mobile economic agents and competitiveness-concerned member state governments, helped by a few ruthless decisions by the European Court of Justice.

The same underlying consideration can also be expressed as follows. True, owing to some of the reasons adduced above in support of the subsidiarity principle, the member states constitute a more suitable level than the EU as regards the political feasibility of strongly redistributive social policies. But with the four freedoms strongly entrenched and their potential gradually perceived throughout the EU, the economic feasibility of generous social policies at that level decreases day by day. [7] This is no doubt something we could and should have anticipated from a brief glance at the United States. The bulk of whatever redistribution there is in the US happens at the federal level, mainly today in the form of solidarity with the elderly (through Social Security and Medicare) and with the working poor (through the Earned Income Tax Credit). The fact that so little inter-personal redistribution is happening in the US at the level of individual states can safely be attributed, more than to any other factor, to the “four freedoms” US residents have long enjoyed across states. This strongly suggests that it is high time to question the subsidiarity-based presumption in favour organizing inter-personal solidarity at the national level. Failing to do so may not just drive the generosity of our welfare states down to the American level, which we are so keen to stigmatize. It seems bound to drive us even lower.

Three more reasons for systematic trans-national transfers

Trans-national redistribution is not only needed as a result of intra-national redistribution becoming economically less sustainable. It is also needed as such for three additional reasons, logically independent but mutually reinforcing. Firstly, we need trans-national as an insurance device against the asymmetric shocks and diverging trends to which the member states are subjected in a context in which the single market favours greater sectoral specialization while globalization creates permanent uncertainty. Especially in the Eurozone, where the instrument of currency adjustment is no longer available, an automatic stabilizer in the form of transfers from the areas that are more competitive and gain more from globalization and the single market to the other areas constitutes an intelligent way of buffering risks and thereby enabling member states to take fuller advantage of more integrated markets. [8]

Secondly, trans-national transfers operate as population stabilizers. In the linguistically and culturally more diverse context of the EU, labour migration to the more affluent member states is far more disruptive than it is across state borders in the United States. Therefore, it happens less often and hence fails to play the adjustment role it plays in the US. Therefore too, it should not happen as often. The greater negative externalities of migration in linguistically more diverse Europe make the stabilizing role of trans-national transfers all the more important.

Thirdly and most fundamentally, EU-wide trans-national transfers are increasingly felt to be required directly by social justice. In a context of ever growing trans-national trade and mobility, communication and debate, it is becoming increasingly surrealistic to assume that issues of distributive justice can arise only between citizens of the same member state. On the one hand, we are becoming aware of how the EU’s very existence, institutional framework and policies affect the material prospects of the citizens of all member states. In addition, Europe’s citizens are increasingly involved, individually or through an ever wider range of associations, in an EU-wide conversation, an EU-wide forum of argumentation, contestation and justification, which is less and less reducible to bargaining for mutual benefit among the representatives of the member states to which they belong. It will still take a while before social justice will be self-evidently identified with global justice. But the realization that it needs to be conceived and pursued at EU level is around the corner.

Minimum standards?

In order to take proper account of these two considerations, I have no doubt that we shall have to go further than the imposition of common minimum standards of social policy to all member states. This is trivially the case for the second consideration — minimum standards entail no trans-national solidarity. But it is also the case for the first consideration — the need to step in for failing intra-national solidarity — because of two difficulties intrinsic to the minimum standards strategy. One goes, in the US discussion, under the label “unfunded mandates”: a higher unit of government cannot legitimately impose a costly duty on lower units, especially the poorer among them, unless it is willing to cover at least part of the cost.

The other difficulty takes the form of a dilemma. Either the standards are quite detailed and therefore in sharp tension with the principle of subsidiarity. Or they remain quite vague, typically in the form of a minimal share of social expenditure in GDP, but they then raise intractable problems once it is realized how important it is that they should capture the “hidden welfare state” (the implicit transfers embedded in the tax system), disentangle sheer insurance (which involves no ex ante redistribution) from solidarity proper, and address the impact of social policy on the pre-tax-pre-transfer distribution of income. [9]

Against this background, direct involvement of the European Union in the organization and funding of the most redistributive components of social policy is no longer just a distant dream but an urgent necessity. The necessity may remain a dream, however, if we cannot come up with any practical way of making it happen. Three models are worth thinking about.

Means-tested Euro-stipendium ?

First, there is the model neatly illustrated by Philippe Schmitter and Michael Bauer’s (2001) “Euro-Stipendium” proposal. What they propose, is “the payment each month of a stipulated amount of Euros to all citizens or legal permanent residents living within the EU whose total earnings amount to less than a third of the average income of everyone living within its borders”. Such a proposal amounts to a massive means-tested transfer to all European households below some poverty line. It sounds consonant with the subsidiarity principle, at least understood this time as “Let the lower level try first, and only intervene at the higher level if it fails”. And it clearly addresses head on the need for direct EU involvement stemming from the two considerations spelled out above.

However, leaving out some correctable defects, the Euro-Stipendium proposal suffers from two major flaws. Firstly, its implementation requires a standardized, uniformly implemented notion of income: For example, how is household composition taken into account? Who counts as a member of the household? How is the income of the self-employed assessed? What about income in kind? Should home ownership be counted as an implicit income? How vigorously must income from informal economic activity be tracked? The harmonization of the relevant income notion and its firm and uniform implementation are essential to the legitimacy and hence to the sustainability of the scheme. But they would raise in each member state such sensitive issues that any EU scheme that relies on such a notion is a pipe dream.

Secondly, it is easy to understand that the design of such a means-tested trans-national scheme is intrinsically perverse. Just think of two countries with same GDP per capita, and suppose that one has a more unequal distribution of disposable income and hence a greater proportion of poor people, say owing to lousy educational and social policies. It is intrinsic to any such scheme that this country will be rewarded for the lousiness of its anti-poverty policies, and the other country punished for its good performance. A scheme that makes net trans-national transfers a positive function of the poverty gap is bound to provide both perverse rewards and perverse incentives and hence to be both very unfair and very inefficient. [10]

EU Co-payment?

One obvious and more familiar alternative is co-payment. It is quite commonly used in countries in which the administration of social assistance is a decentralized — typically municipal — competence, while part of the funding is centralized, precisely to avoid the “unfunded mandate” problem mentioned above.

This works fine when the more centralized level is firmly in control of most of the other instruments of social policy. But if the co-payment of social assistance is envisaged between the European Union and the member states, very strong, unnecessary and undesirable constraints on the member states’ autonomy in designing their own social policies are bound to emerge.

This is the case, first of all, because the European Union will understandably want to have a say on the benefit levels and eligibility conditions of the programmes it co-funds. This is also the case, with far broader implications, because the EU will need to block the member states’ understandable temptation to dump onto the co-funded social assistance scheme people who would more usefully be covered by other branches of their transfer system (disability allowances, old age pensions, child support, student grants, employment subsidies, etc.). From the members state’s standpoint, these other schemes have the disadvantage of having to be funded exclusively out of their own resources, and shifting some of the cost to the EU level by reducing eligibility to these schemes will be hard to resist. To keep such moral hazard under check, active EU regulation throughout the social policy realm will be required, at the expense of the considerations that support the subsidiarity principle.

Universal Euro-dividend?

Is there an alternative? Yes, there is: what could be called a Euro-dividend, a modest universal basic income paid to all legal residents of the European Union and entirely funded at EU level, which can be topped up at will at a national or sub-national level by other universal benefits, by a means-tested and conditional social assistance scheme and of course by a social insurance system. [11]

The level need not be uniform across the Union. It can reflect differences in purchasing power (not in GDP per capita, which would amount to cancelling the trans-national redistributive effect). The funding must be centralized, but it should definitely not consist, for the reasons hinted at above, in an EU-wide personal income tax. The VAT is a more appropriate instrument or, more innovatively, a “super-Tobin” tax on all electronic transactions. Moreover, an energy or carbon tax could provide part of the funding, as could the phasing out of agricultural policy transfers, possibly also of social and structural funds, for which the Euro-dividend would provide a partial substitute. [12] A gradual introduction is conceivable, but the steps should not consist in income categories, regions, or sectors, but in age groups. One could envisage a universal basic pension, as already exists in several member states, or perhaps more sensibly given the demographic situation of the EU, in the form of an EU-wide child benefit. [13]

No need here to find a uniform definition of disposable or taxable income. No perverse incentives for the nations states’ anti-poverty programmes. And no unnecessary restriction of the member states’ room for innovation or adjustment to local conditions and preferences. Far from imposing top-down a mega welfare state, a firm common floor for the most redistributive dimension of social policy keeps fiscal competition and social dumping under check and thereby allows each member state to maintain and improve its own preferred version of the welfare state. As an antidote to the race to the bottom, this bottom-up conception of an active social Europe is fully compatible with subsidiarity properly understood.

Far more would need to be said about how much readjustment in the other components of the welfare state this third model of direct EU involvement would require; about how it would handle migration, legal and illegal, from outside the EU; about how a universal basic income approach can be viewed as a central component of the so-called “active welfare state” in its emancipatory (as opposed to repressive) version; and about how it fits into a conception of distributive justice as real freedom for all. But I have tried to do so elsewhere [14], and my point here is only to explain why the basic income proposal is so important if one is to meet the need for an inter-personal transfer system at a supra-national level. However urgent this need and however neatly a universal Euro-dividend would meet it, however, the latter may still make little sense because of being politically out of reach.

Political feasibility

Is such an ambitious model of EU-level social policy politically feasible? Definitely not now. But this is not the end of the story. It is a call for sharp thinking and resolute action in order to make possible what is indispensable. First of all, we need a thicker European civil society. There are already far more people active in Brussels because of the presence of the EU’s institutions without working for them than there are Eurocrats in the strict sense. We need more of them. We need stronger EU-wide social partners, more and stronger EU-wide associations and lobbies of all sorts which weave together all layers of EU society, not just the economic, political and cultural elite, and enables people across Europe to understand each other, identify with each other, and mobilize together. An active social Europe will only come about if it can be “bottom up” in this sense too.

Next, we need electoral institutions at EU level that make it rewarding to construct and publicly defend the general interest of the European population as a whole. We might think, as some have proposed, of a direct election of the President of the European Commission or of the European Council. But there is no need to ape the United States. With our national cleavages and parliamentary traditions, a different option is preferable: the election of some small percentage of the members of the European Parliament in a single EU-wide consistency, combined with an increase in the specifically European stakes of the EU parliamentary elections, for example by making the choice of the president of the European Commission depend on the electoral scores in this constituency. [15]

Thirdly, we need a thorough democratization of competence in one single lingua franca, which will — need I say — be English. One of the key conditions for a viable generous social policy beyond the level of a nation state is a lively democratic forum, and hence an ability to communicate conveniently and mobilize effectively across borders. This ability must be widely shared by all classes of citizens, not only the rich and powerful who can afford the wonderful but expensive help of interpreters and translators. Only the learning of a common language can achieve this. If we want to circumvent Mill’s indictment of multinational and especially multilingual democracy, if we want to enable the EU to do what it needs to do, we need to accelerate the acquisition and appropriation of English as a second language throughout the European continent. The satisfaction of this third condition is essential for the first two to produce their full impact. It is bound to produce some undesirable side effects, which need to be identified and addressed. But the ability to communicate cheaply and effectively through a shared language will be as essential to the mobilization that will produce EU-wide institutionalized solidarity as it was to the mobilization that produced our national welfare states. [16]

All this makes for many tasks ahead, both intellectual and political. Too many, some may feel inclined to say, and too tough. Yet, there is no option but to take them on. There will be hesitations, standstills, probably even serious regressions owing to the conditions just mentioned not being sufficiently met. But the direction should be clear, in the general interest of us all Europeans, but also as an essential step in the learning process that will yield the institutions we need on the world level: in order to make minimally fair and efficient collective decisions, in order to forestall deadly wars for increasingly scarce resources, indeed in order to make human life on earth sustainable.

This is the immodest mission of the EU’s unprecedented experiment. There is no time to waste. Avanti!

[Please Note: That as of this time nine Eurozone states have been stripped of their triple-A rating by Standard & Poor’s due to their debts.

This paper was prepared for the proceedings of the conference on Global Justice organized in July 2011 at the Universitate Nova, Lissabon. Early versions of the core ideas of this text were presented under the title “Bottom-up social Europe” at the Conference on “The Future of European Social Policy” organized by the Finnish Presidency of the European Union (Helsinki, 10 November 2006) and at the seminar on “Basic Income: A concept for decent living and working conditions for everyone” organized by the green group in the European Parliament (Brussels, 3 July 2007)]

Notes

1. The conception of justice expounded and defended in my book Real Freedom for All (Van Parijs 1995) corresponds to just one way of satisfying these desiderata. Other « liberal egalitarian » conceptions of justice include those proposed by John Rawls (1971), Ronald Dworkin (2000) and Amartya Sen (2009).

2. I spell this out in Van Parijs (2007) and chapter 1 of Van Parijs (2011b).

3. See the famous chapter 16 (“On nationality”) of his Considerations on Representative Government (1861).

4. For this reason, the most important and most specific contribution the European Union can make to global justice is not through its development aid programme, nor even through its contribution to fair deals in matters of climate change or international trade, by gradually constructing the socio-economic and political institutions which are required by the pursuit of social justice on a scale that does not match that of a nation-state.

5. See the essays collected in Van Parijs ed. (2004).

6. See Välimäki (2006: 275): “The following of the subsidiarity principle has also implied that the member states have not actively promoted the social dimension of the Union. This has created a paradox. The EU influences member states’ policies more through the internal market than expected. If the member states were interested in strengthening EU social policy, the EU’s impact on the member states’ systems would be less.”

7. The fact fact that no race to the bottom is detectable so far when looking at shares of social expenditure in GDP should not mislead us. There is no reason to expect the bulky and swelling mass of earnings-related old age pensions to be under strong pressure. But the genuinely redistributive part of the welfare states is, as shown for example in falling ratios of benefits to earnings (Obinger 2005).

8. Since I first wrote this passage, as part of my 2006 keynote lecture in Helsinki, its relevance has been made considerably more salient by the “Greek crisis” and the subsequent crisis of the euro. The fifty US states have been able to cope happily with huge divergences for decennia despite their inability to adjust through the devaluation of distinct currencies. The fundamental reason is that the impacts of these divergences on the states’ per capita incomes and public budgets are systematically buffered by two mechanisms: inter-state migration and the massive tax-and-transfer system practically entirely organized, as mentioned before, at the federal level. As the first of these mechanisms is bound to remain more modest and/or more problematic in the EU context (for reasons explained in the next paragraph), there is no way in which the Eurozone can avoid permanent havoc without a trans-national transfer system even more developed (though far simpler) than what exists at the federal level in the US.

9. Standards of this sort have been proposed for example by Fritz Scharpf. See the discussion in Scharpf (2000) and Van Parijs (2000).

10. For discussion, see Schmitter & Bauer (2001), Van Parijs & Vanderborght (2001), Matsaganis (2001), Bauer & Schmitter (2001) and Howard (2006).

11. The oldest known formulation of such a proposal at EU level can be found in a 1975 report to the European Parliament’s Economic and Monetary Affairs Committee by the British MEP Sir Brandon consist in bringing into line all the basic welfare systems of the community, as a way of removing one powerful barrier to the free movement of workers and their families. A first step could be made with a unified community-wide child benefit system (which individual countries would be free to top up). “A further step forward would include a full-scale tax-credit system incorporating a structure of positive personal allowances as a feature of the community tax system.” Such a basic income system, in his view, has two advantages that are particularly relevant in the European context. First, it would “provide an opportunity to carry through a regional policy at personal level, since it would […] carry purchasing power outwards from the centres of wealth to the districts and even into the houses where incomes are below the average”. Second, “it would help to raise the incomes of farmers with low earnings without interfering with the prices of their products”, and thus provide a partial alternative to the Common Agricultural Policy. He concludes: “The European Social Contract must combine the benefits of security and unity afforded to the citizens of communist societies with the personal freedom and self-respect which are the best characteristics of the property-owning democracies.” (Basic Income 4, Spring 1989, www.basicincome.org). See also Genet & Van Parijs (1992) and Van Parijs (1996).

12. Along these lines, see Genet & Van Parijs (1992) and Schmitter & Bauer (2001), respectively.

13. A warm supporter of moves towards a basic income in national contexts, Anthony Atkinson (1996) argues that basic income “has particular salience in the European Union, where it can provide a secure foundation for a Europe-wide minimum income”, beginning with a basic income for children pitched at a level related to the general income level of each country.

14.See Van Parijs (1995), Vanderborght & Van Parijs (2005), Van Parijs (2009), Van Parijs (2012).

15. More generally, having part of the Parliament’s seats allocated on a polity-wide constituency is arguably a necessary condition for the smooth running of a parliamentary democracy in a polity deeply divided along territorial lines. See Deschouwer & Van Parijs (2010) and Van Parijs (2011a: esp. chapters 5, 9 and 10).

16. In chapter 1 of Van Parijs (2011b), I make the case of a single lingua franca, and in the subsequent chapters I discuss at length the issues of justice its adoption gives rise to.

References

Atkinson, Anthony B. 1996. “The Distribution of Income: Evidence, Theories and Policy”, in De Economist 144, 1996, 1-21.

Bauer, Michael W. & Schmitter, Philippe. 2001. “Dividend, Birth-Grant or Stipendium?” Journal of European Social Policy 11 (4), 348-52.

Deschouwer, Kris & Van Parijs, Philippe. 2010. Electoral Engineering for a Stalled Federation, Re-Bel e-book n°5, Brussels: The Re-Bel initiative, www.rethinkingbelgium.eu.

Dworkin, Ronald. 2000. Sovereign Virtue: The Theory and Practice of Equality. Cambridge, MA: Harvard University Press.

Genet, Michel & Van Parijs, Philippe. 1992. « Eurogrant », Basic Income Research Group Bulletin 15, 4-7.

Howard, Michael. 2006. « “A NAFTA Dividend: A proposal for a guaranteed minimum income for North America”, Basic Income Studies 2, 2007.

Matsaganis, Manos. “The Trouble with the Euro-Stipendium”, Journal of European Social Policy 11 (4), 346-48.

Mill, John Stuart. 1861. Considerations on Representative Governement, in On Liberty and Other Essays, J. Gray ed., Oxford: Oxford University Press, 1991, 203-467.

Obinger, Herbert. “The Dual Convergence of Welfare States”, paper presented at the Center for European Studies, Harvard University, 9 February 2005.

Rawls, John. 1971. A Theory of Justice. Cambridge, MA: Harvard University Press.

Scharpf, Fritz. 2000. “Basic Income and Social Europe”, in Basic Income on the Agenda, R.J. van der Veen & L. Groot eds., Amsterdam: Amsterdam University Press, 2000, 154-160.

Sen, Amartya. 2009. The Idea of Justice. Cambridge (Mass): Harvard University Press.

Schmitter, Philippe & Bauer, Michael W. 2001. “A (modest) proposal for expanding social citizenship in the European Union”, Journal of European Social Policy 11 (1), 55-65.

Sen, Amartya. 2009. The Idea of Justice, London: Penguin.

Välimäki, Kari. 2006. “Seeking a New Balance”, in The Europeanization of Social Protection. The Political Responses of Eleven Member States, Juho Saari ed., Helsinki: Ministry of Social Affairs and Health, 261-277.

Vanderborght, Yannick & Van Parijs, Philippe. L’Allocation universelle, Paris : La Découverte, 2005. (Portuguese translation: Renda básica de Cidadania. Argumentos éticos e economicos, Rio de Janeiro: Civilizaçao Brasileira, 2006.)

Van Parijs, Philippe. 1995. Real Freedom for All. What (if Anything) Can Justify Capitalism?, Oxford : Oxford University Press.

Van Parijs, Philippe. 1996. « Basic Income and the Two Dilemmas of the Welfare State », The Political Quarterly 67 (1), 63-66.

Van Parijs, Philippe. 2000. « Basic Income at the Heart of Social Europe? Reply to Fritz Scharpf », in Basic Income on the Agenda, R.J. van der Veen & L. Groot eds., Amsterdam: Amsterdam University Press, 2000, 161-169.

Van Parijs, Philippe & Vanderborght, Yannick. 2001. « From Euro-stipendium to Euro-dividend », in Journal of European Social Policy 11 (4), 342-46.

Van Parijs, Philippe ed. 2004. Cultural Diversity versus Economic Solidarity. Brussels: De Boeck Université. Downloadable from www.uclouvain.be/en-12569.

Van Parijs, Philippe. 2007. « International Distributive Justice », The Blackwell’s Companion to Contemporary Political Philosophy(R. Goodin, P. Pettit & T. Pogge eds.), Oxford: Blackwell, Vol. II, 638-52.

Van Parijs, Philippe. 2009. “Basic income and social justice: why philosophers disagree”, Joint Joseph Rowntree FFoundation/ University of York Lecture 2009, www.jrf.org.uk/sites/files/jrf/van-parijs-lecture.pdf

Van Parijs, Philippe. 2011a. Just Democracy. The Rawls-Machiavelli Programme. Colchester : ECPR Press.

Van Parijs, Philippe. 2011b. Linguistic Justice for Europe and for the World. Oxford : Oxford University Press.

Van Parijs, Philippe. 2012. “Basic Income in a Globalized Economy”, keynote lecture at the Congress of the American Sociological Association, Denver (Colorado), August 2012.

[Thank you Philippe for sending this hot off the press]

The writer directs the Hoover Chair of Economic and Social Ethics at the University of Louvain (Belgium) and is a Visiting Professor at the Law Faculty of Oxford University. His books include Marxism Recycled, Real Freedom for All: What (if anything) Can Justify Capitalism?, What’s Wrong with a Free Lunch?, and Just Democracy: The Rawls-Machiavelli Programme.