by Anjan Chakrabarti

Last time the Indian economy ran into a major systemic crisis was in the late 1980s. It was a result of and also the final nail in the coffin of state sponsored planned economy. Along with the collapse of Soviet style command economies, it signalled the unsustainability of an economic system built on absolute or near total control of the state over the economy. That crisis helped spread the philosophy of neoliberalism in India which led to this lesson from the experience of centralized planning: for the goals of rapid economic growth and poverty reduction, state control over the market economy does not work and hence should be abandoned. Since then, a structural adjustment program evolved as a gradual process of two decades, giving rise to a competitive market economy that is integrated into the global economy; as against the privileged position of planners, this new paradigm also protracted the supremacy of the mass of homoeconomicus (optimizing economic man, whether as consumers or producers) whose decision making transpiring in and through this global competitive market regime are supposed to generate the economy wide outcomes that are efficient.

A connection between microeconomics and macroeconomics is thus made whereby the macroeconomic outcomes were seen as result of microeconomic behaviour in a competitive market economy[1]; it was believed that such a connection would produce a high growth rate regime, stable and reasonable inflation and rapid employment in the industrialized sector (inclusive of manufacturing and services). Among the microeconomic decision makers were, of course, the global capitalist enterprises which, like the homoeconomicus as consumers, were taken as privileged for they were seen as essential instruments of generating high value and hence growth. Evidently, this competitive market economy helped create and facilitate global capitalism in the Indian economy. It is to this structural change that we move next.

Problem over sharing the Indian growth miracle

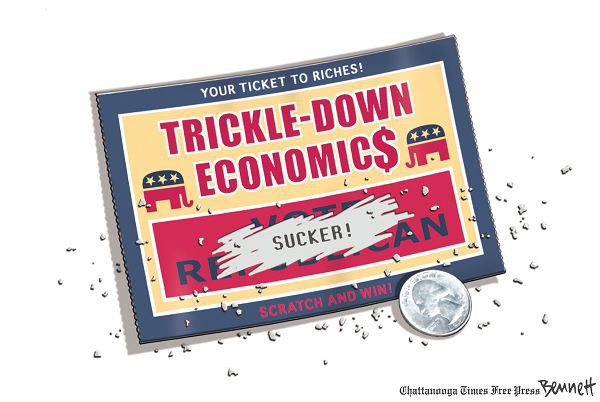

As it has evolved gradually through an assortment of reforms, this paradigm shift produced a structural remapping of Indian economy taking the shape of ‘circuits-camp of global capital’ qua global capitalism and its outside ‘world of the third’.[2] This changing map of the Indian economy was driven by, among other things, the primacy accorded to global capitalist performance, appropriation and distribution of surplus which, via high growth rate, resulted in the expansion of the ‘circuits-camp of global capital’; this expansion, not surprisingly, meant a war on, or primitive accumulation of, ‘world of the third’.[3] In other words, the process of primitive accumulation ensured that growth has been exclusionary (that is, devoid of trickle down effects), where the exclusion has taken two forms: first, by excluding a vast section of the population from the benefits of rising income growth, a phenomenon symbolized by a worsening Gini coefficient; and second, further exacerbating existing social inequities (based on caste, ethnicity, gender, etc.). In fact, the dual phenomena of income inequality and social inequity compensated, complemented and reinforced one another to exclude a large section of the Indian population (residing in the margins of the ‘circuits-camp of global capital’ and ‘world of the third’) from the benefits of economic growth. There is also, due to measurement problems, some controversy over the exact trend of income poverty, and there is a strong indication that non-income factors of poverty (captured by the statistics of malnutrition, health, education, etc.) may have stagnated or worsened.

The overall picture is that of a country of increased prosperity (concentrated in the hub of the ‘circuits-camp of global capital’) but with a growing divide as well. The event of exclusionary growth was acknowledged and internalized by the policy circle and many economists after the disaster of ‘Shining India’ in the 2004 elections; it was agreed that exclusionary growth must be tempered by an attempt to include the left out population through redistribution of benefits of economic growth; inclusive development aspires to become the new national trope supposedly uniting Indians, notwithstanding their other differences, into a single national project of development in which all are participants and beneficiaries.[4] Rather than being in conflict, this imagery sees growth and redistribution as complementarity; high growth (that is, a bigger pie) sustains greater redistribution and greater redistribution in the form of more productive investment among the poor is supposed to secure and propel further growth. Global capitalism (‘circuits-camp of global capital’), working via the competitive market economy, is thus not only good in itself because it rapidly expands growth. It also has instrumental value by delivering direct benefits of growth (the trickle-down effect) and indirect benefit of growth (through redistribution) to reduce poverty; the former will function through the market (which, in the Indian case, even the policy makers agree is weak), and the latter through the intervention of the state.

At another level we can interpret this imagery and its underlying policy paradigm as trying to combine the capitalist performance, appropriation, distribution and surplus in a global setting that is fundamentally private-centric and the domain of redistribution which is fundamentally state-centric. Thus, the Indian state now encapsulates two rationales, one liberal (minimal interference in the competitive market economy, that is, in the ‘circuits-camp of global capital’) and the other dirigiste (directly intervening and controlling the redistribution process to ‘world of the third’); it combines these to secure the modernization process via the expansion of global capitalism (or, ‘circuits-camp of global capital’). This is projected as a truly win-win situation which is a result of the gift of globalization and the benefits derived from it in the form of enhanced wealth creation that the integration of the Indian economy into a globalized world has enabled. Not only has the Indian growth miracle permanently arrived, but inclusive development enables the entire country – all of the population – to share and be a partner in this miracle. It is of course another matter that rulers at different times spare no effort in producing and disseminating pictures (in which nothing can seemingly go wrong) that in the end turn out to be delusional; previously, the picture of ‘Garibi Hatao’ and ‘Shining India’ were two such pictures. As in all case of delusional pictures that promise everything to everybody, this imagery is now in a state of crisis in more than one way. We discuss an axis of that crisis here.

Microfoundation of macroeconomics: A recipe to end depression or to begin one

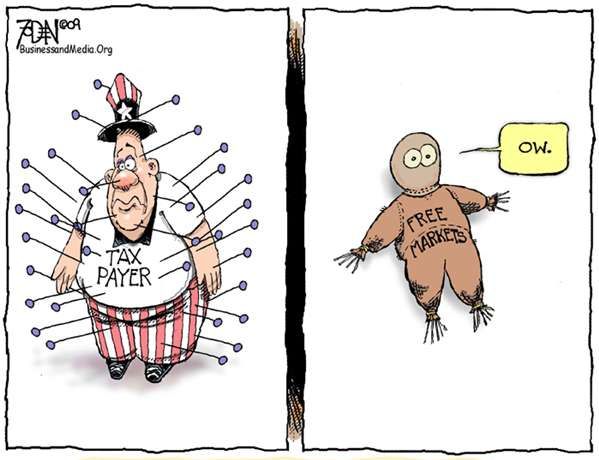

Critical to this imagery is the assumption of high growth; an assumption bolstered no doubt by the actual realization of a high growth rate regime which in turn is traced to the creation of a competitive market economy. This in turn has led to a sacrosanct belief and robust defence of the competitive market economy as against state intervention/control, and global capitalism as against national capitalism. However, since 2007, that growth story is in serious danger which in turn forces our attention to areas taken thus far as immune from discussion. In fact, the Indian economy’s trouble expands well beyond the faltering growth story. In the last five years, the Indian economy has slowly moved into a terrain of a deep crisis, perhaps in the same scale as the earlier one; in the sense that it is threatening to take the semblance of a systemic crisis. This time though, with a drastically truncated role of the state vis-a-vis market and weak trade union opposition, the blame for this crisis can only fall on the combined effects of neoliberal globalization and global capitalism or the mechanism of global capitalist centred production, distribution and consumption of goods and services functioning through the conduit of a competitive market economy. Is it then the case that the source of the systemic crisis resides in the illness of a competitive market economy? This though is not the accepted position; nor is it yet the point of debate in India.

Prime Minister Manmohan Singh insists that the Indian economy’s fundamentals are robust, and hence its growth story, while faltering in the short run, is protected in the long run. If we accept Keynes’ dictum that ‘in the long run we are all dead’ (by the way, five years is not a very short period either) which in no small part is substantiated by the overdetermined and contradictory processes pulling and pushing the Indian economy into who knows where, then a question crops up — What is meant by saying that the fundamentals of the economy are strong?

Now, surely the prime minister is not referring to the macroeconomic fundamentals. A cursory glance at the basic indicators tells a sorry story on that front: the growth rate is falling, inflation rate is resiliently high (transpiring, says the Reserve Bank of India, mostly from supply side factors which keep exacerbating the problem), falling private saving and investment, growing current account deficit driven mainly by a worsening trade deficit, pressure on the capital account, declining rupee value and at times volatile exchange rate movement, and increasing fiscal deficit. This is indeed a case of fundamentals gone haywire and which seem to be resiliently invariant to policy changes (pertaining to fiscal, monetary and exchange rate regimes), that are transpiring rapidly, being fired from all possible directions; this trouble is in fact finding further fodder through the global inter-linkages that is exporting the global problems into India in plentiful forms (the deleterious effects from Europe being the latest addition) thereby aggravating an already difficult situation.

The trouble is not merely that the economy is faltering, but that the process is transpiring in a dynamic environment that is private (competitive market economy) and global, in which many processes/variables are not under the control of the policy makers if they are at all known to them in the first place. So much has been talked about the benefits India has garnered from its integration into the global economy; and our mainstream friends would like us to be held captive by that picture. Yet, the last five years have shown that there is a cost to this integration too which now can hardly be left unquestioned. A lesson: there is no win-win harvesting from globalization. Like all other entities, the process of globalization is beset with overdetermination and contradiction, throwing up unpredictable outcomes and harbouring unknown possibilities, and for a competitive market economy integrated into a globalized world also suggests the existence and the need to not only accept the possibility of business cycles, but also of breakdowns.[5]

If not macroeconomics, it then appeals to reason that the prime minister must be referring to the strong fundamentals pertaining to the microeconomic environment; this can only mean the competitive market economy materializing from the liberalization policies of the last two decades. The suggestion here is that creating such an economy has succeeded in producing a level effect meaning that the minimum bar on the growth rate has been permanently raised as compared to that of the planning era. As a justification of this position, the high growth rate in the previous decade is presented as a proof. If this is accepted then it follows that the neoliberal policies by creating this competitive market economy have done a service to India. Because of the level of high growth rate, India stands a better chance not only to become richer but also reduce its poverty sharply.[6] But then, if we are to accept this, how do we reconcile a sound microeconomic environment with a disturbing macroeconomic picture? How could the two sets of fundamentals be moving in opposite directions? Can they in the first place do so? This leads to a deeper issue as the following argues. Let us begin by positing the position of neoliberal economics.

That a sound microeconomic picture can co-exist with a systemic failure at the macro level is contrary to the neoliberal dictum which theorizes a picture of macro economy emanating from microeconomics; this is now the consensus of mainstream neo-classical economics. In addition to this frame as being methodologically robust in the sense of capturing the concrete reality, it is further held that a competitive market economy functioning with a supporting but non-intervening state will produce better macroeconomic outcomes than otherwise.[7] And, to cap it all, such an economic system rules out systemic failures such as depression; any state interference here will produce an inferior outcome or worse; the role of the state is only to ensure that a competitive market economy is created, facilitated and secured from outside interference (such as anti-competitive practices, trade union activities, expropriation, etc.) and its own discretionary behaviour (following rules is better than discretionary policies). The confidence entrusted in this new paradigm can be gauged from the following quote in a Nobel Prize acceptable speech by Robert Lucas:

Macroeconomics was born as a distinct field in the 1940’s, as part of the intellectual response to the Great Depression. The term then referred to the body of knowledge and expertise that we hoped would prevent the recurrence of that economic disaster. My thesis in this lecture is that macroeconomics in this original sense has succeeded: Its central problem of depression prevention has been solved, for all practical purposes, and has in fact been solved for many decades. There remain important gains in welfare from better fiscal policies, but I argue that these are gains from providing people with better incentives to work and save, not from better fine-tuning of spending flows. Taking U.S. performance over the past 50 years as a benchmark, the potential for welfare gains from between long-run, supply-side policies exceed by far the potential from further improvements in short-run demand management. (Robert E. Lucas, JR. 2003)

Coming from arguably the chief architect of modern macroeconomics and the economist principally responsible for demolishing Keynesian macroeconomics, the claim that depression – the term mainstream economics uses to signify economic breakdown as opposed to business cycle or fluctuations around trend which is regular – is over was a colossal claim[8]; colossal but also one which fell flat with the appearance of the global economic crisis. It showed that macroeconomics has still not solved its self-proclaimed central problem of depression and by corollary that what some such as Paul Krugman calls the ‘voodoo’ economics of supply-side is, to put it mildly, deeply problematical. Paraphrasing Lucas from our vantage point it appears that Marx’s observation of a capitalist economic system containing the seeds of its breakdown was true in the 1940s as it is now. The trouble is that the ‘voodoo’ economics continues to be the dominant economics, whereby its influence is deeply rooted in the current policy making circles; even as depression can no longer be denied, the theoretical consensus that had resulted from the anti-Keynesian revolution enacted by supply side macroeconomics continues to hold considerable sway. And this theoretical consensus presents a deeper trouble. It lies in the inherent claim that a global capitalist regime under the conditions of free agents functioning in a competitive market economy with minimal state interference will lead to the disappearance of systemic failure such as that epitomized by depression.

If evidence is any proof (and economists revel in it), then we can conclude that there must be something fundamentally wrong with the axiom of Cartesian methodological individualism in a competitive market economy producing a depression free system. This hypothesis evidently rules out any autonomy to the economic structure which is specified in neoclassical economics as general equilibrium economy. If autonomy of structure is granted then that could carry the possibility of effects and outcomes irreducible exclusively to the optimising behaviour of the agents interacting through the market.[9] However, unless we agree that this autonomy exists, it becomes difficult to locate and explain the appearance of the current economic crisis that is now global. That being the case, one of the central hypotheses of neoliberal economics – if individuals are free decision-makers, markets are self-regulating and hence sufficient for the system – becomes moot. Markets do have unique features and effects, but to enable a depression free economy is certainly not its forte. In short, the framework of neo-liberalism or its economic discipline of neoclassical economics cannot explain systemic collapse.

In contrast, Keynes and Marx, in their own different ways, insisted on the relative autonomy of the structure, a relative autonomy that can be traced to the structure and, at times, the non-optimising behaviour of the agents. It has also been suggested by others that parts do not add up to the whole; that the whole also needs to be specified and analysed in terms of its unique features and effects.[10] This is not to say that individual decisions and markets do not influence the structure (we believe that they certainly do), but that structure cannot be seen as mere sum total of individual decisions.

If, in contrast, we accept that indeed microeconomic foundations produce macro economy or even go with our milder proposition that microeconomics do partially, but not totally, influence macroeconomics, then one must confer some quarter of blame (and if we are to follow the framework of neoclassical economics) to the kind of basic economy that constitutes microeconomics. Merely blaming the Indian economic crisis on the global economic crisis (a common refrain among Indian policy makers now) sidesteps the issue we are raising here[11]. Since the 1980s, the neo-liberalization of the global economy has produced a transformation towards a competitive market economy, a move that was propelled by developed countries (Harvey 2007). But it is precisely in the latter that the global nature of the current crisis originated and spread[12]. If indeed we accept that macroeconomic outcomes are a result of agents’ decision-action in a competitive market economy, then surely it is that economy which must be held accountable for the outcome. In other words, instead of the fundamentals of microeconomics being good, they must be seen as deeply problematical and could be held as containing seeds of instability and destruction at a broader level.

The above underscores that microeconomic environment constituted by the competitive market economy populated by free agents can and does produce economic and social disasters, as it has; far from being self-regulating, markets may produce, as it has, self-annihilation leaving people, regions and even nations struggling to survive. Therefore, not only do we get the insufficiency of the neoliberal qua neoclassical framework in locating and explaining depression (as we argued earlier), but we additionally also find its chief logical conduit of explaining the functioning of economic systems faltering. Surely, there is something wrong with this microeconomic environment which in turn calls for a rethinking of the basic economic system itself, the way production, distribution and consumption of goods and services materialize under capitalist form. One the other hand, if one still maintains that microeconomic fundamentals are sound, then one will have to concede that there is a dissonance between micro and macro, that macro economy has relative autonomy including possibilities of structural failure. This realization entails the role of the state including active policy ones pertaining to control of the economy, if prevention of economic crisis or disaster (or, what Lucas called depression) is considered a desirable objective.

Perhaps, the current economic crisis in India shows that both the aspects are true: there is a problem with the basic economic system produced by global capitalism functioning through a competitive market economy and that a role of the state as an active and intervening player in the economy is necessitated. The importance of the first was argued for by Marx whereby he related the macroeconomic crisis (the crisis of capitalism as such) to the contradiction, convulsion and failure of the competitive market economy functioning through capitalist organization of surplus and suggested the abortion of capitalism as a recipe for resolving the macro crisis. He thus favoured a systemic transformation. The second issue was taken up by Keynes when he suggested the role of the state in overcoming recession and ensuring smoothening of business cycles by actively intervening in and influencing the market economic outcomes — a point we saw was fiercely opposed by Lucas and his acolytes.

This also shows that while both Marx and Keynes appreciated the relation between macro and micro (albeit in very different ways), Marx argued that systemic instability and disaster cannot be averted except by replacing capitalism as a system and Keynes suggested that the same can be averted, that is, capitalism saved with the active role of the state preventing business cycles from turning into possible depression. Not surprisingly, neoliberalism as an economic-politico philosophy is not just hostile to Marxism, but also to Keynesianism (even as Keynes’ objective was to save capitalism). Leaving aside their differences, it is perhaps more pertinent to realize that the current economic crisis has demonstrated that the suggestions of both Marx and Keynes, in tandem, need to be taken seriously. Notwithstanding the prime minister’s allusion to strong microeconomic fundamentals which is tantamount to taking the competitive market economy as sacrosanct that in turn demands a thin role of the state, it is perhaps time to seriously question this conjecture and begin a debate on both the nature of the economic system and the state; to debate them not distinctly, but in tandem as in overdetermination. It is my position that in the current climate of India, this is not happening, either from the Right or Left.

Conclusion

Policy paralysis appears in a different way here. The policy paralysis is a paralysis of thinking that shuts out any solution other than what is the ‘consensus.’ A competitive market economy with capitalist appropriation and distribution of surplus in a global setting is the consensus in this historical episode that, however, also continues to burden us with a growing set of changes or ‘reforms’ that deepen the very processes and system which are responsible for this crisis. How and in what manner these so-called ‘reforms’ are going to put the Indian economy back on track are issues not touched upon. How they are going to put some sanity into our present unstable and volatile systemic regime is left untouched. Indeed, in a scenario where the malaise is a systemic encompassing both the micro and macro, it is hardly surprisingly that the policies are not working. The debate from the Radical side is disturbing too, being stuck on the need for the enhanced role of the state which is, at times, combined with the nationalist trope of self-reliance. There is hardly any questioning of, and debate on, the issue of systemic transformation and the politics of producing it. Well, we have moved from a state sponsored development paradigm to a private market economy driven paradigm, and found both to be wanting. Changing the role of the state (say moving towards a strong state) without challenging the economic system is unsustainable as history has shown us; in fact, both must be addressed together. To put it somewhat differently, both the micro and macro, in tandem, must be made the object of questioning and transformation.

References

Chakrabarti, A and Dhar, A. K. 2009. Dislocation and Resettlement in Development: From Third World to ‘world of the third’. Routledge: London.

Chakrabarti, A and A. K. Dhar. 2012. “Gravel in the Shoe: Nationalism and ‘world of the third’,” Rethinking Marxism, 24 (1).

Chakrabarti A, A. K. Dhar and Cullenberg, S. 2012. Global Capitalism and ‘world of the third’, World View Press: New Delhi.

Harvey, D. 2007. A Brief History of Neoliberalism. Oxford University Press, USA.

Lucas, Robert, JR. 1976. “Econometric policy evaluation: A critique”. Carnegie-Rochester Conference Series on Public Policy 1 (1): 19-46.

Lucas, Robert, JR. 2003. “Macroeconomics Priorities”, American Economic Review, Vol. 93, No.1.

Resnick, S. and R, Wolff. 2010. “The Economic Crisis: A Marxian Interpretation”, Rethinking Marxism, 22 (2). [This can be found on this site at: link]

End notes:

1. Chakrabarti, Dhar and Cullenberg (2012).

2. Our usage of the terms such as ‘circuits or camp of global capital’ and ‘world of the third’ follows the theoretical insights of Chakrabarti, Dhar and Cullenberg (2012) and Chakrabarti and Dhar (2009, 2012) who produce a unique frame to analyse the historical phenomenon of modernization in the Southern setting. In the context of our current issue, these terms can be roughly put in the following way. Following liberalization policies in India, spurred by its wide industrial base (paradoxically, a gift of its previous import substitution policy) and fairly advanced higher education system (also paradoxically courtesy of its erstwhile planning system), Indian industries, particularly the big business houses, gradually adjusted to the rules and demands of global competition and, along with new enterprises, mutated into global capitalist enterprises. Through outsourcing and sub-contracting, they forged relations with local enterprises procreating and circumscribed within a nation’s border (the local market) and with enterprises outside the nation’s border (the global market); it is the symbiotic relation through local-global markets that allowed the formation of circuits. Specifically, via the local-global market, global capital was linked to the ancillary local enterprises (big and small scale, local capitalist and non-capitalist) and other institutions (banking enterprises, trading enterprises, transport enterprises, etc.) and together they formed the circuits of global capital. Rapid growth of the Indian economy propelled by the expansion of the circuits of global capital (inclusive of manufacturing and services) is feeding an explosive process of urbanization, and producing along the way a culture of individualization and consumerism. It is being complemented by new-fangled notions of success, entrepreneurship and consumerism, of ways of judging performance and conduct, of changing gender and caste relations, customs and mores, etc. Resultantly, what appears is a social cluster of practices, activities and relationships capturing literally the production of an encampment: we name it as the ‘camp of global capital.’ This camp, especially its hub, is becoming the nursery ground of a new nationalist culture bent on dismantling extant meanings of the good life in India and replacing it with the tooth-and-claw model that emphasizes competition, possession and accumulation. We refer to circuits-camp of global capital as global capitalism. Evidently, in the formation, global capital is taken as the privileged centre.

World of the third, on the other hand, is conceptualized as an overdetermined space of capitalist and non-capitalist class processes that procreate outside the circuits of global capital. A large number of these ‘non-capitalist’ class processes are independent, feudal, communitic, slave and communist as also capitalist class enterprises of simple reproduction type. World of the third is thus a space that is conceptually never part of global negotiations; it is outside, if we may borrow a term from Gayatri Chakravarty Spivak, the Empire-Nation exchange, where Empire-Nation exchange refers to exchanges within the local-global market connected to the circuits of global capital. In short, world of the third embraces an overdetermined cluster of class and non-class processes procreating outside the circuits of global capital and are knotted to markets as well as to non-market exchanges. Social cluster of practices, activities and relationships connected to the language-experience-logic-ethos of this space constitute the camp of world of the third. It may be recalled that what for us is world of the third is for modernist discourses (like colonialism, development, and so on) third world: this is the Orientalist moment through which the modern emerges as the privileged centre. Third world supposedly contains inefficient practices and activities; as nurturing excess labor, labor that is presumed to be unproductive and hence a burden on society; as harboring a large reserve army of the unemployed/underemployed. In short, it is re-presented as a figure of lack. The foregrounding category of third world then provides an angularity to world of the third thereby foreclosing its language-experience-ethos-logic and discursively producing a deformation of its practices, activities and relationships. One does not get to appreciate the possibility of an outside to the circuits of global capital; one thus loses sight of the world of the third. Instead, what awaits us is a devalued space, a lacking underside – third world – that needs to be transgressed–transformed–mutilated-included. Thus, world of the third is brought into the discursive register and worked upon, but without taking cognizance of its language-logic-experience-ethos. Critically, this foreclosure of world of the third through the foregrounding of third world (or, by substitute signifiers such as social capital, community, etc.) helps secure and facilitate the hegemony of (global) capital and modernity over world of the third. Taken together, a knowledge formation emerges in which global capital and modernity emerges as the privileged centres. Chakrabarti et. al. unravels and critiques this knowledge formation and through the return of the foreclosed world of the third lays down the contour of a contesting way to theorize the Southern context.

3. Chakrabarti and Dhar (2019).

4. Chakrabarti and Dhar (2012).

5. On being quizzed as to whether India’s integration into the global economy has made it more prone to shocks and instabilities, a friend of mine holding a senior position in a financial institution suggested a few years back that one reason why a competitive market economy is good is because it enhances the ability of the economic system to absorb and internalize shocks; this is by no means a very uncommon refrain, at least till a few years ago. In short, breakdowns can never happen. I wonder what he has to say now.

6. Of course, as we have seen, the question of ‘who is exactly becoming richer or becoming richer much faster than others’ has raised a few hackles and is on its own a question of some importance.

7. Unlike a robust state (of command economies or welfare capitalism) which believes in ‘more governance is good governance’, neoliberalism believes in, at the level of political philosophy at least, ‘less governance is good governance.’ Of course, given the astonishing quantum of plunder, violence and destruction produced in the name of ‘freedom’ that is neoliberal in nature, one must take this refrain with a grain of salt. But then we are discussing its logical conduit here.

8. It is notable that macroeconomics not only originated in the West, but its central problem is fundamentally that of the modern market economy as well. The USA and Europe have been the theatre of macroeconomics and developments there influenced the macroeconomics discipline and the policy paradigm of the state not only in Europe but all over the world. In this sense, macroeconomics has been imperial in nature or should we say it is an indispensable component of any imperialist policies bent on modernization. Interestingly, three episodes of systemic breakdown or depression produced three turns in macroeconomics in the West that in turn enforced a switch in macroeconomic understanding and management across the world. The first was the depression of the 1930s that saw the collapse of the classical paradigm (emphasizing the dichotomy between nominal variables such as money and real variables such as output) which disparaged state intervention; this collapse saw the concurrent rise of Keynesianism (emphasizing that the classical dichotomy is wrong, at least in the short run) which maintained that state intervention and active stabilization policy is necessary to prevent depression and this could be done since there is a trade-off between inflation rate and unemployment and between unemployment and output. The second episode of depression was marked by stagflation in the USA (high inflation and stagnating output) in the late 1960s which even in the face of active stabilization policy to exploit the mentioned trade off failed to get the economy out of depression; this failure of stabilization policies saw the collapse of Keynesian economics and the rise of supply side or new classical economics that once again reiterated the classical dichotomy and the inherent inability of the state to improve welfare in the face of active and enterprising individuals. It was shown that not only did state-led stabilization policy fail to improve the welfare, but also that such interventions created inefficiencies of all kinds. Important in this attack was the paper of Lucas (1976) that showed that there is something methodologically wrong in the way Keynesianism poses its own macroeconomic structure; it does so, he claims, by treating the individuals as docile, passive who would not react to changes in the stabilization policies, precisely what the liberals have condemned as contravening the principle of freedom.

Arguing that it is fundamentally wrong to treat the individuals as bereft of agency, he showed that with the introduction of stabilization policies, rather than being passive to the changes brought about by the state, the agents will internalize that information and change their behavior which in totality will produce an outcome very different from (and inferior to) the case in which it is presumed (as under Keynesianism) that individual behavior will remain invariant to change in policies. The Keynesians, contrary to what the liberals would emphasize, took the structure as primary and tried to fit in the individual to this structure (the attempt of what came to known as Keynesian-neoclassical synthesis) when the liberal economists such as Lucas and Edward Prescott were emphasizing the method to be the other way round: the individual was to be the primary unit from which the structure is to be derived; not surprisingly then, for the neoliberal economists (the new classical/real business cycle school) the neoclassical micro structure became that fundamental ground and (macro)economy was the derived general equilibrium structure over which macroeconomic analysis and policies are to be examined. The invariance principle and inability to posit the microfoundation of macroeconomics constituted the basis on which Keynesian macroeconomics was attacked and the stabilization role of the state found wanting; the macroeconomics that developed through this attack and reconstruction via microfoundation become the missile head of neoliberalism in the field of economics and policy making. The third episode of systemic crisis or depression is the global economic crash since 2007 which has turned the table on neoliberal macroeconomics which has claimed that it has solved the problem of depression by legitimizing the creation of a competitive market economy made of private players and in which stabilization policy of the state is not encouraged; a systemic crisis that rose not because of state or any third party intervention (since, in the last three decades they were heavily discouraged) but through the very mechanics of the private competitive market economy which certainly did not do the reputation of neoliberal macroeconomics any good. What will come out of this crisis in the field of macroeconomics is yet to be seen though no doubt it has exploded the myth of the fundamental proposition of neo-liberal macroeconomics. As it stands now, macroeconomics lies in tatters.

9. In modern macroeconomics, general equilibrium is after all the point of reference and departure (even in case of New Keynesian economics where markets are shown to be failing as a result of the behaviour of agents in a free market environment).

10. Micro and Macro divisions are typical of mainstream economics and not of Marx or Marxism. Accepting the importance of not reading or writing on Marx by reducing him to this structure, in this presentation at least, we invoke Marx with reference to this division of micro and macro for the sake of organization that includes an encounter with neoclassical economics. Rather than reducing Marx to neoclassical economics, it is to highlight the uniqueness of Marx’s contribution.

11. This comes on top of the fact that this blaming is hardly stopping the policy makers from taking ‘reform’ policies that deepen India’s integration into the global economy and hence, by their own confession, must be taken as increasing the possibilities of transporting global crisis into the Indian economy. In other words, the ammunition that they are supplying with the intent to overcome the crisis may end up deepening it. At least, the policy makers need to spell out clearly as to why this would not happen.

12. For a superb analysis of US economic crisis, see Resnick and Wolff (2010).

[Thank you Anjan for this incisive piece]

Note: This piece was also recently published at Radical Notes as “The faltering miracle story of India”.

The writer is Professor of Economics, Calcutta University. He is the author of’ Transition and Development in India (with Stephen Cullenberg), Dislocation and Resettlement in Development: From Third World to ‘world of the third’ (with Anup Kumar Dhar) both published by Routledge; and ‘world of the third’ and Global Capitalism (with Anup Kumar Dhar and Stephen Cullenberg) published by Worldview Press.

If publishing or re-posting this article kindly use the entire piece, credit the writer and this website: Philosophers for Change, philoforchange.wordpress.com. Thanks for your support.